Why Using a Credit Card Responsibly Is Good For Your Finances

There’s no denying that when credit cards are used irresponsibly, they can lead to financial ruin. That’s why they receive a lot of attention for the negative impact they can have on personal finances. However, not all consumers fall victim to living above their means and entering a cycle of revolving debt that can be difficult to emerge from. For those who utilize credit cards responsibly, they can be an integral tool in a consumer’s financial toolbox. Consider the following reasons every adult should consider using a credit card:

They provide an emergency fund. Financial planners will, of course, tell you it’s best to have a stash of emergency cash in an easily accessible bank account, but recent polls show that many Americans simply aren’t able to save enough for unforeseen expenses. A credit card ensures that emergencies won’t leave you unable to pay your rent, childcare or other necessary expense.

They can actually boost your credit score. Lenders look for evidence that you pay your debts, so establishing a long, positive credit history will actually contribute to higher credit scores over time. The older a credit card account is, the more positively it will affect your credit score – as long as your history also includes making your payments on time, every time.

They can save you money on the things you purchase often. There’s a reason credit card rewards are gaining in popularity – consumers can use them to save money on things like travel and groceries, or get cash back to use at favorite stores and restaurants.

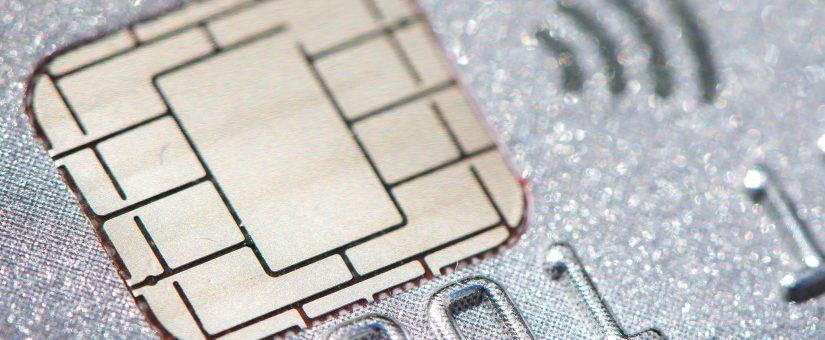

They protect against identity theft. Credit cards are designed with fraud protection that simply isn’t available using cash or even debit cards. If stolen, card purchases can be immediately halted with a simple phone call to customer service.

The savviest credit card users pay the balance down to zero each month. If you have the discipline to do so, credit cards can be a useful financial tool.

Image via Flickr/kuhnmi